Atlendis Lending Tutorial Series: How to Lend Using the Atlendis Protocol

Atlendis Lending Tutorial Series: How to Lend Using the Atlendis Protocol

This tutorial series will explain how liquidity providers can use Atlendis in order to start lending today and earning rewards.

Table of contents

- Introduction | Welcome to Atlendis

- Deposit on the Atlendis protocol

- Withdraw your funds

- Change your rate

- Sell your position

- Pool status, history and credit evaluation

If you would rather watch the video tutorials, here is a playlist of videos covering this article.

Introduction | Welcome To Atlendis

Atlendis is a DeFi protocol that enables authorized institutional actors – including DAOs, protocols and registered businesses in general – to open a specific borrowing pool for each crypto asset that they want to borrow, and take out a line of credit without the need for collateral.

Atlendis powers up institutions with uncollateralized lending by providing a non-dilutive financing option, thus closing the gap with traditional finance. DAOs can now take out a loan without impacting the health of their treasury. Atlendis also opens up new DeFi use-cases like fast withdrawals from one blockchain to another, or new cash management strategies.

The Atlendis protocol went live on June 7th, 2022 with two institutional borrowers upon launch, ZigZag and rhino.fi.

The Atlendis protocol stands-out with innovative features such as the separation of pools between borrowers and between tokens, thus isolating the risk and offering exposure granularity to lenders. The interest rate order book allows lenders to choose their preferred lending rate, and enables borrowers to obtain a fair rate for their loan as the result of a market rate discovery. Finally, the Atlendis protocol deposits inactive liquidity on Aave to benefit the protocol’s basis yield, and a partnership has been made with Credora to support on the whitelisting of borrowers, assess their creditworthiness, and provide a continuously updated credit score for each borrower on the Atlendis protocol.

For more information, the best is to join the Atlendis Discord and don’t hesitate to reach out to the team and the Atlendis community. Additional information can also be found in the documentation or the Atlendis V1 whitepaper.

Deposit on the Atlendis Protocol

From the Atlendis home page, lenders can click on the “Launch dApp” button in the upper right hand side of the page to be directed to app.atlendis.io and interact with the Atlendis protocol.

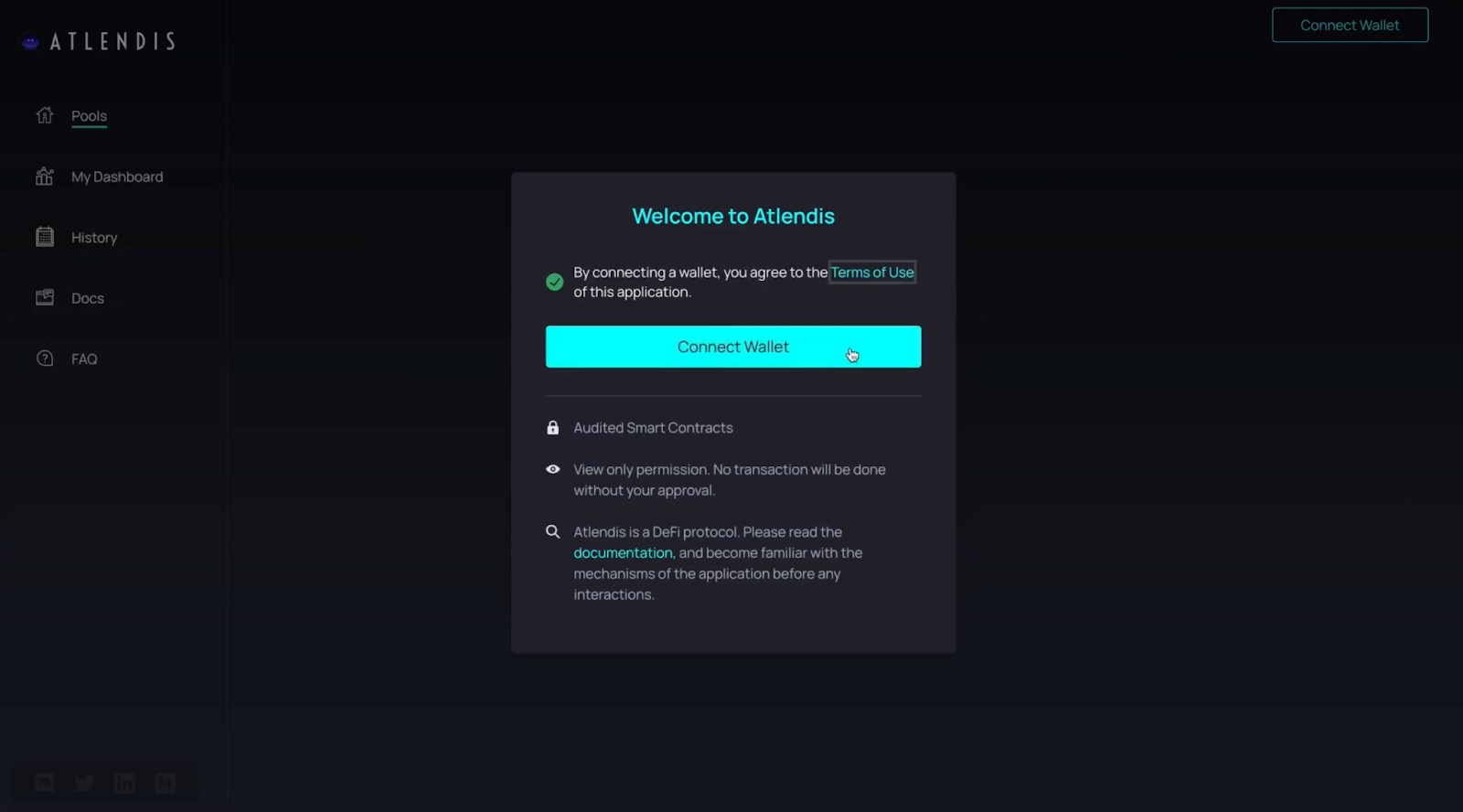

As a Lender wanting to get started and deposit funds, you must first connect your supported wallet using the “Connect Wallet” button. You should be connected to the Polygon network, if not you can accept the prompt from your wallet to switch networks to Polygon.

Now that your wallet has been connected, welcome to the Atlendis World!

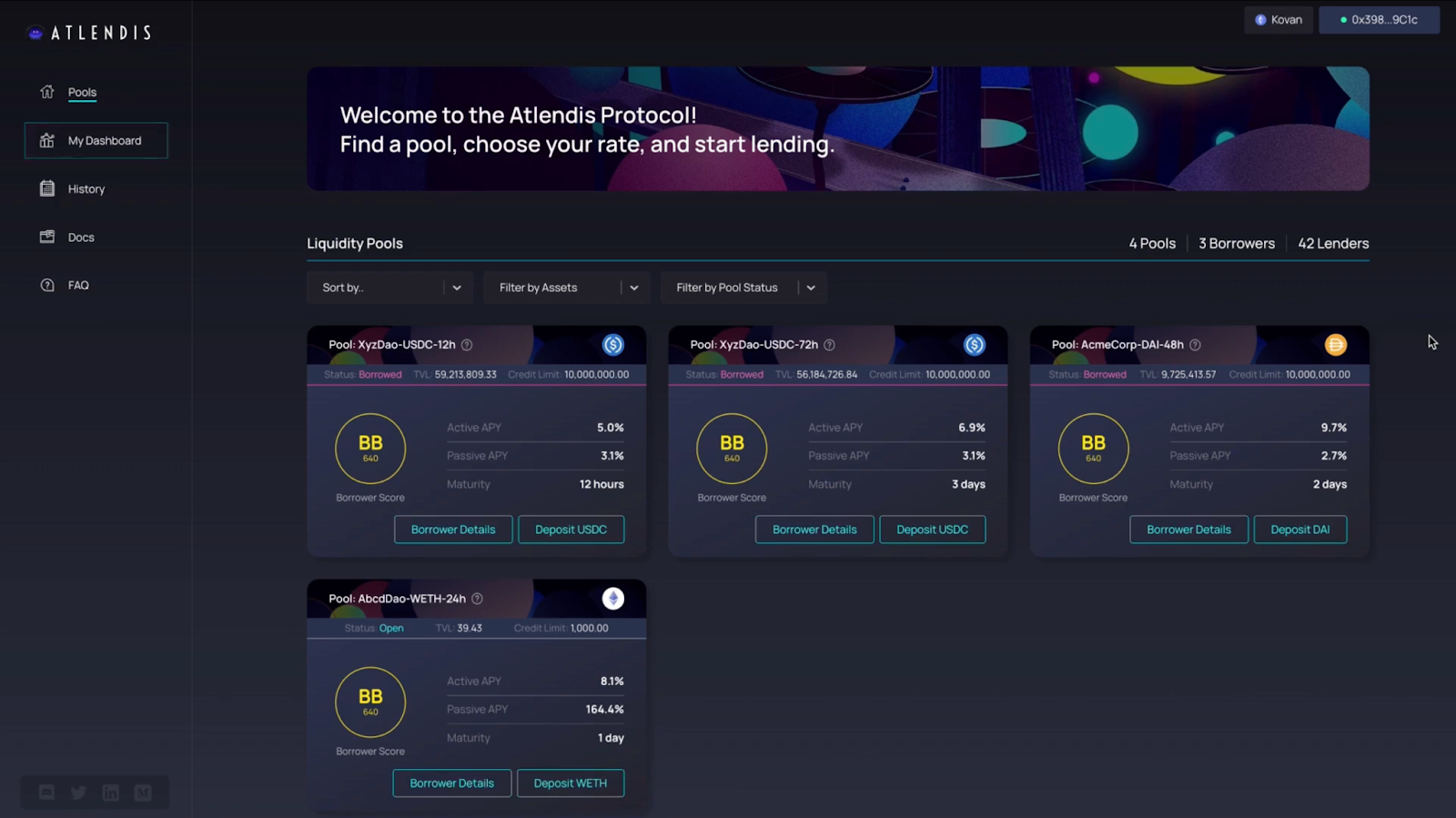

The main menu is presented on the left hand side of the dApp’s front page and includes:

- Pools: this is an overview of all the pools open by different borrowers where you can deposit funds to be borrowed.

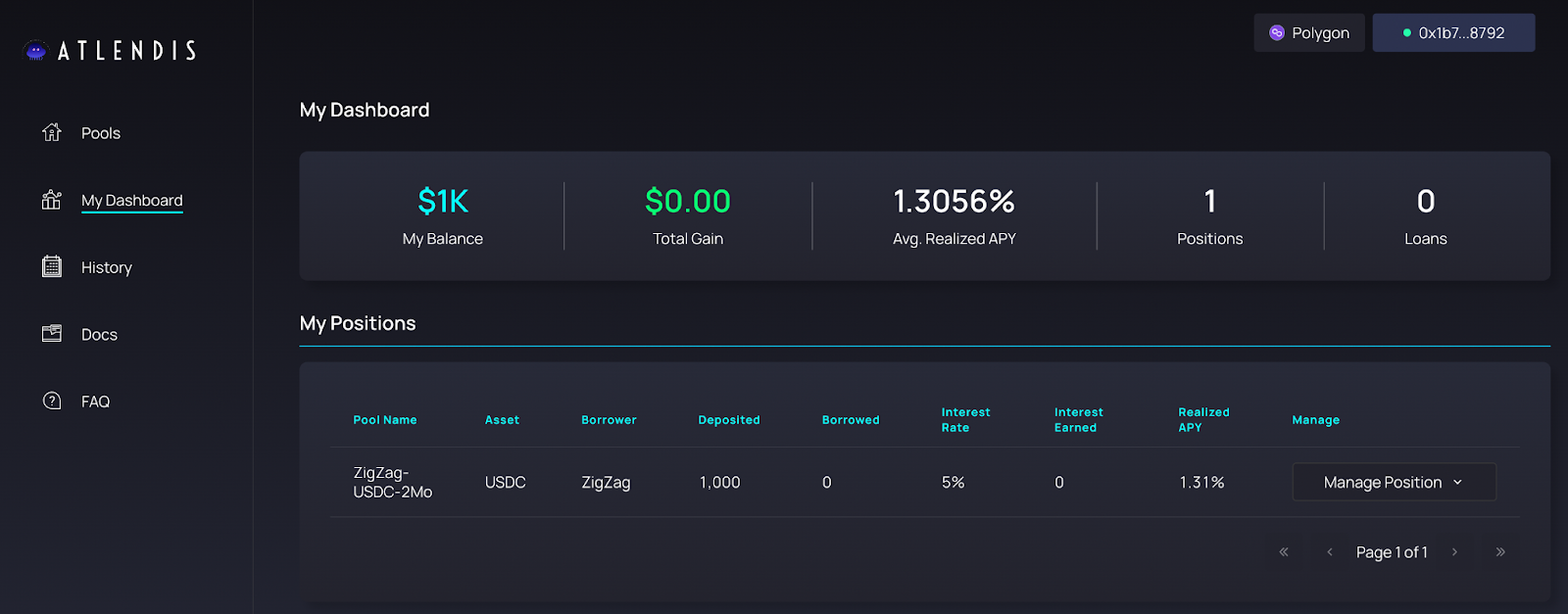

- My dashboard: this enables you to find all of your positions and you can see a range of metrics about your positions.

- History: this shows the history of your own past transactions or actions taken within the dApp.

- Docs: this links to the Atlendis documentation.

- FAQ: this links to the frequently asked questions.

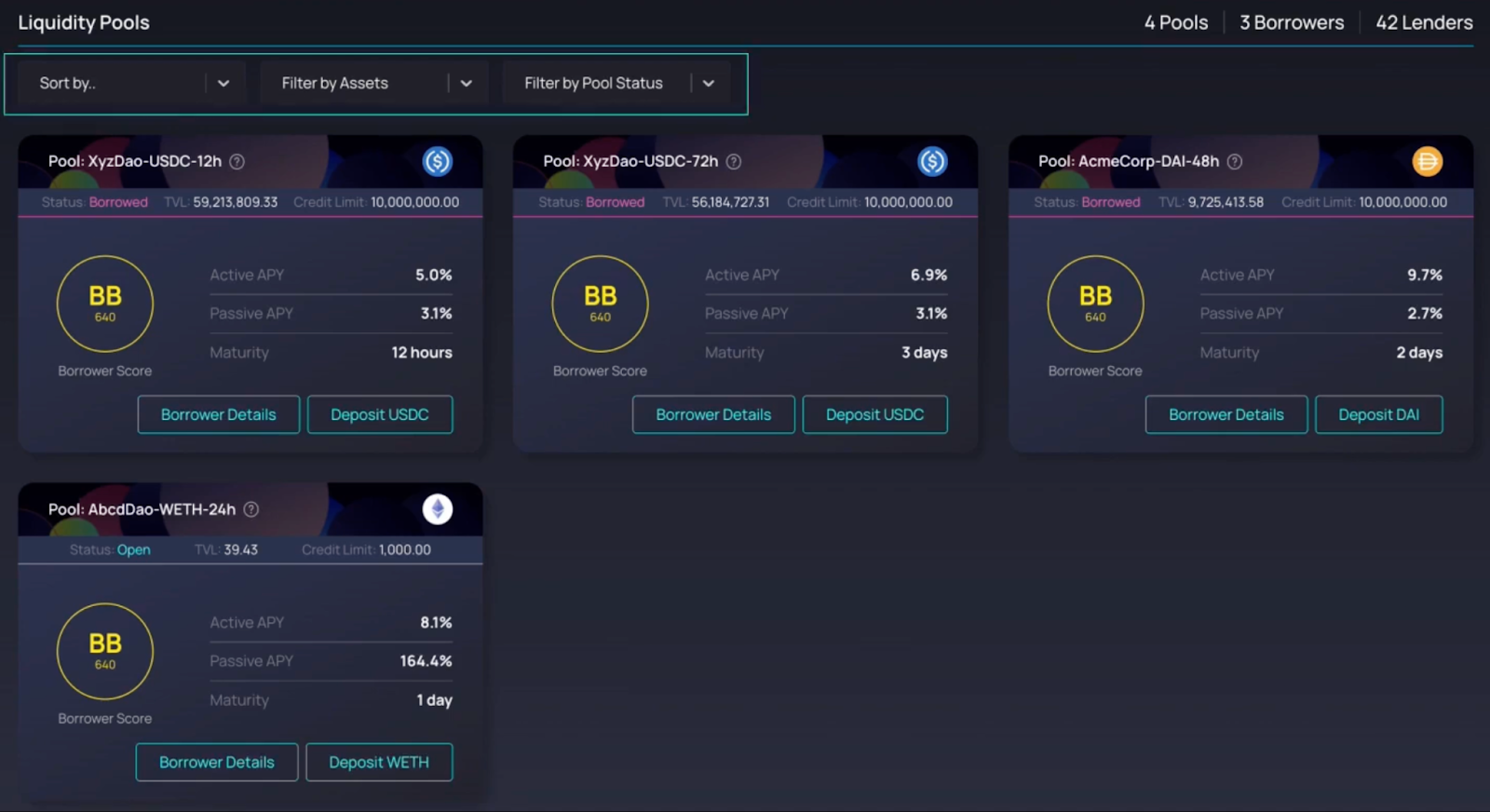

On the dashboard, Lenders can find the “Pools” tab where you can see all the open pools for whitelisted borrowers on Atlendis. You can sort pools by multiple assets and by the status of the pool using the filters.

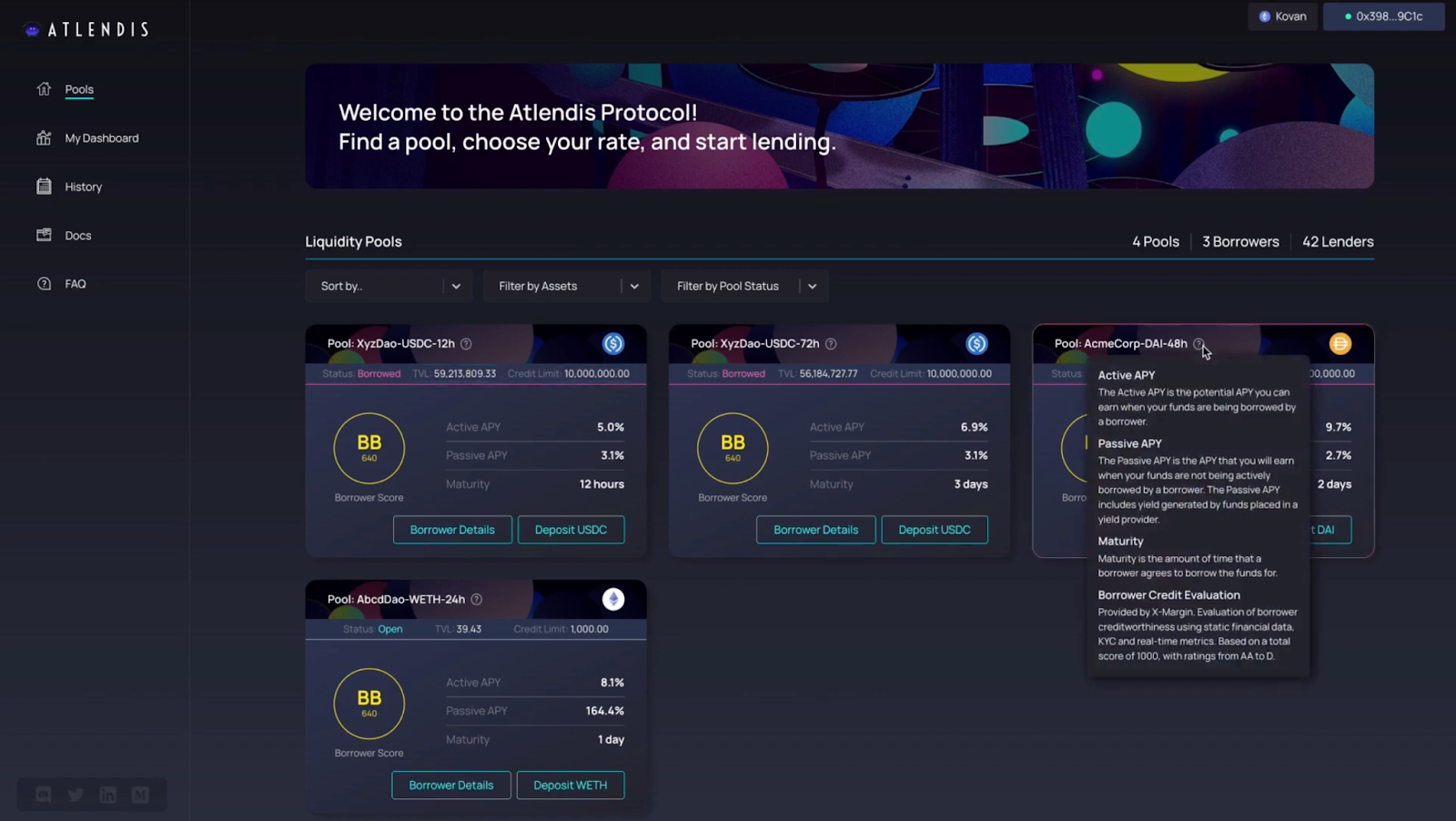

Below are the pool cards. All of the pools where you can deposit will be shown according to the filters you choose, such as by asset, by status, etc. The pool card shows information including “Active APY,” “Passive APY,” “maturity of the loan,” “credit evaluation scoring of the borrower,” “status of the pool,” “TVL” and “credit limit."

You can hover over the question mark to get more details on the meaning of these terms. You can also click on “Borrower Details” to see more details about the borrower (such as their company logo, website and a short description).

Let’s make a first deposit together!

First, choose the pool you would like to deposit into. Click “Deposit” and you arrive on the dedicated pool page.

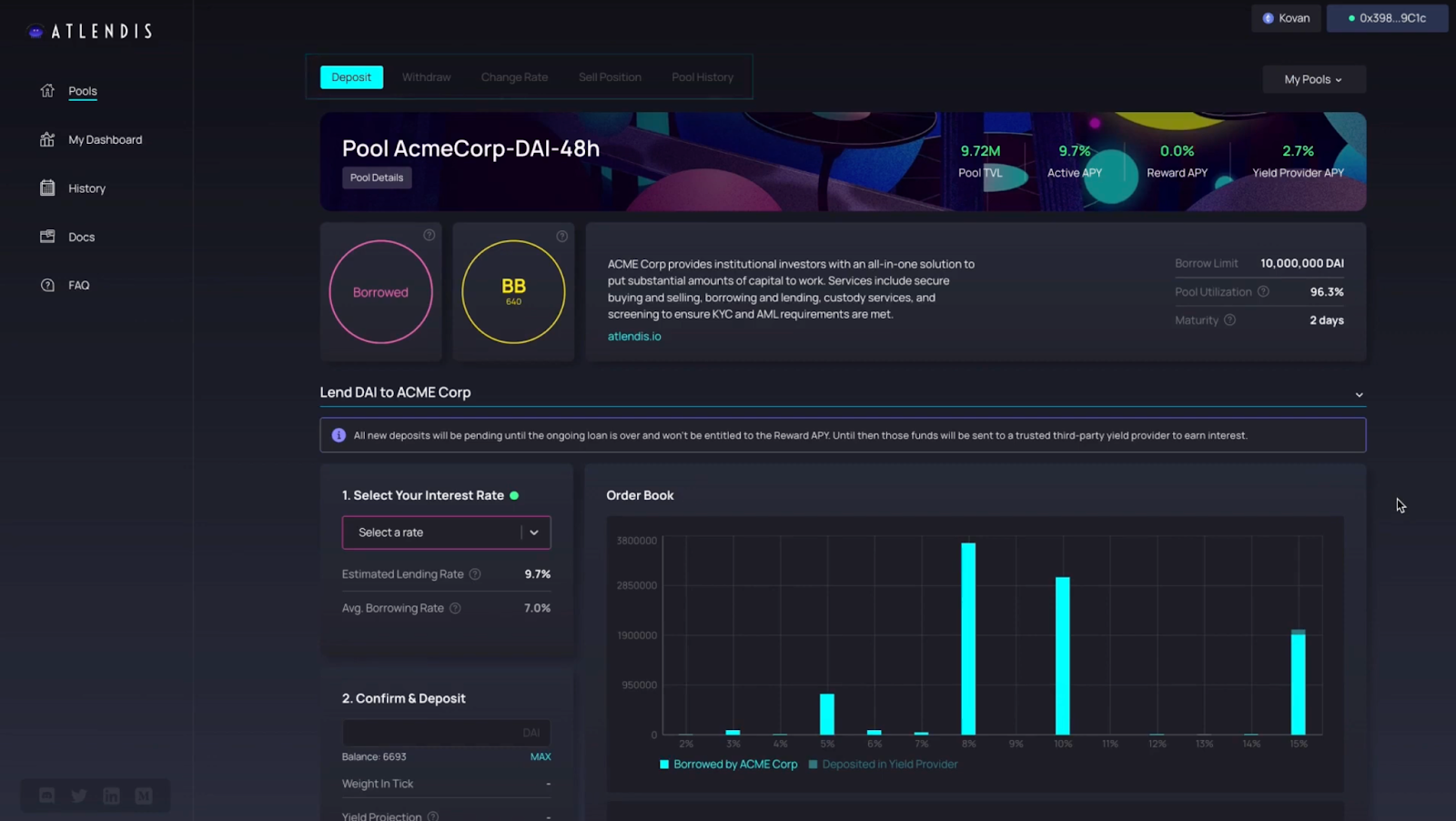

On the top of the pool page, several tabs will allow you to take further actions within this pool that will be covered in further tutorials (like “withdraw,” “change rate,” or “sell position”) and you will also have access to the pool’s loan history (your personal history is visible from the “History” tab).

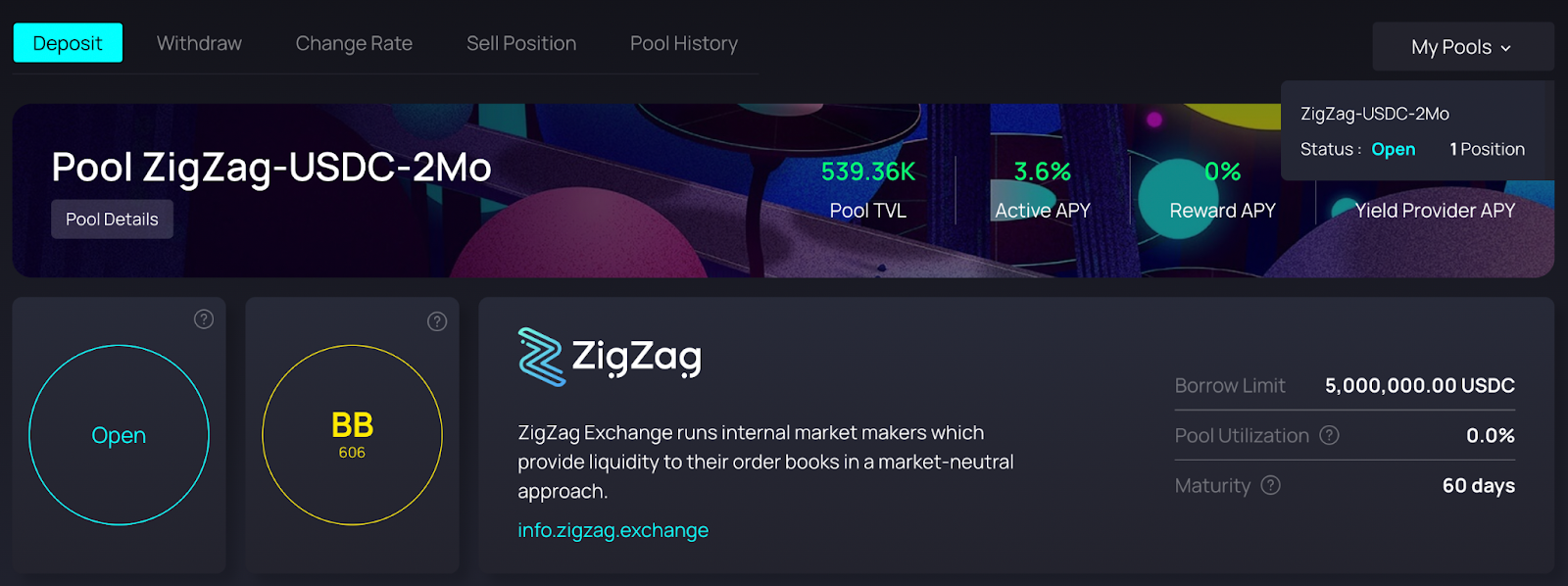

At the top right using the “My Pools” button, you can see your active positions in pools where you have taken action and made a deposit. In this example, we have one position in the ZigZag USDC pool with a 2-month maturity.

The pool bar at the top shows the name of the pool, and the main metrics that you should know, as well as the “status” of the loan – each “status” has a dedicated color. Information about the “borrower” is also displayed (their credit score, a short description of the borrower, and information about the borrower, the borrow limit, pool utilization and maturity of the loan).

When you are ready to lend, first go to “Select Your Interest Rate” and enter the interest rate at which you agree to lend your funds to the borrower. In the order book on your right, you will see an overview of the deposits that have already been made into this pool. You can hover over each bar to get more information.

Next, under “Confirm & Deposit” you can see the balance in your wallet. You can click on “Max” to deposit the maximum available amount in your wallet, or enter an inferior amount manually. Once you have entered the desired amount, click “Deposit.”

When your transaction is successfully completed, a pop up will let you know. Congratulations! You have now deposited into the pool, and you can view your transaction on the block explorer by clicking the dedicated link in the pop-up message.

Please note that if you deposit when there is a loan ongoing in the pool, your deposit will be in a pending state, and included into the order book when the current loan ends.

You can now view your “position” (the deposit that you have just made) in “my dashboard” and in your “history.” If your deposit gets matched with the borrower, you will start earning interests on your loan position!

If you would like to be notified of every action that is taken in the pool by the borrower, you can subscribe to the dedicated Twitter bot.

Withdraw Your Funds

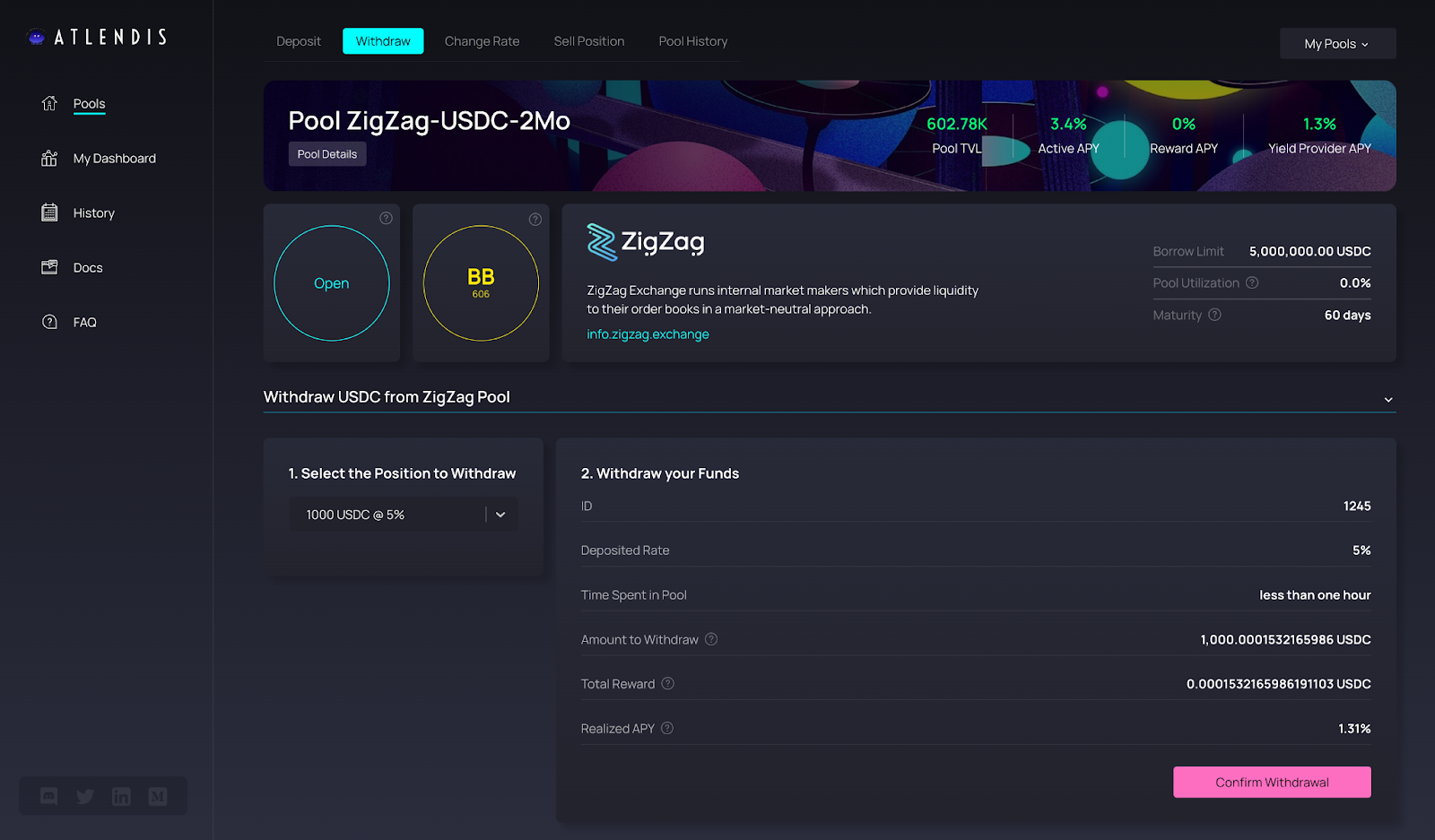

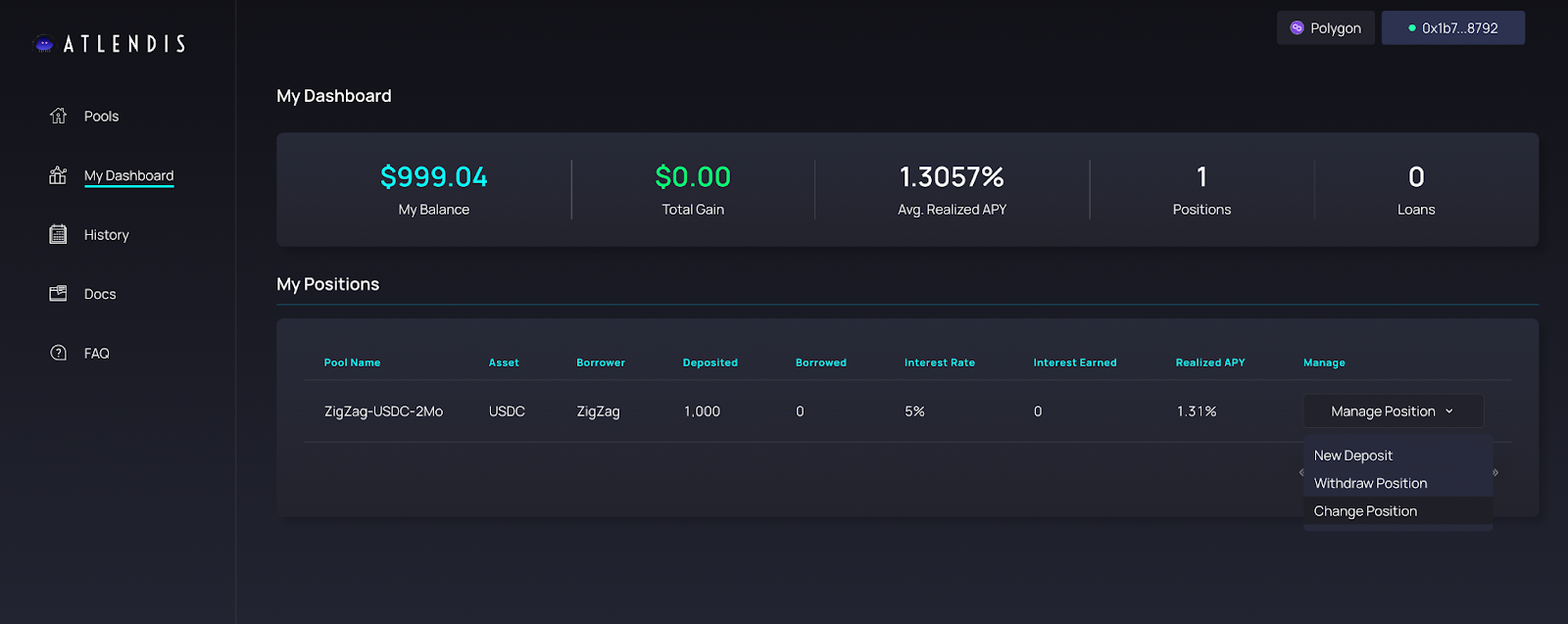

For Lenders who want to withdraw their position when it is not currently being borrowed, from the homepage of the dApp at app.atlendis.io, go to “my dashboard,” and select the position you would like to withdraw.

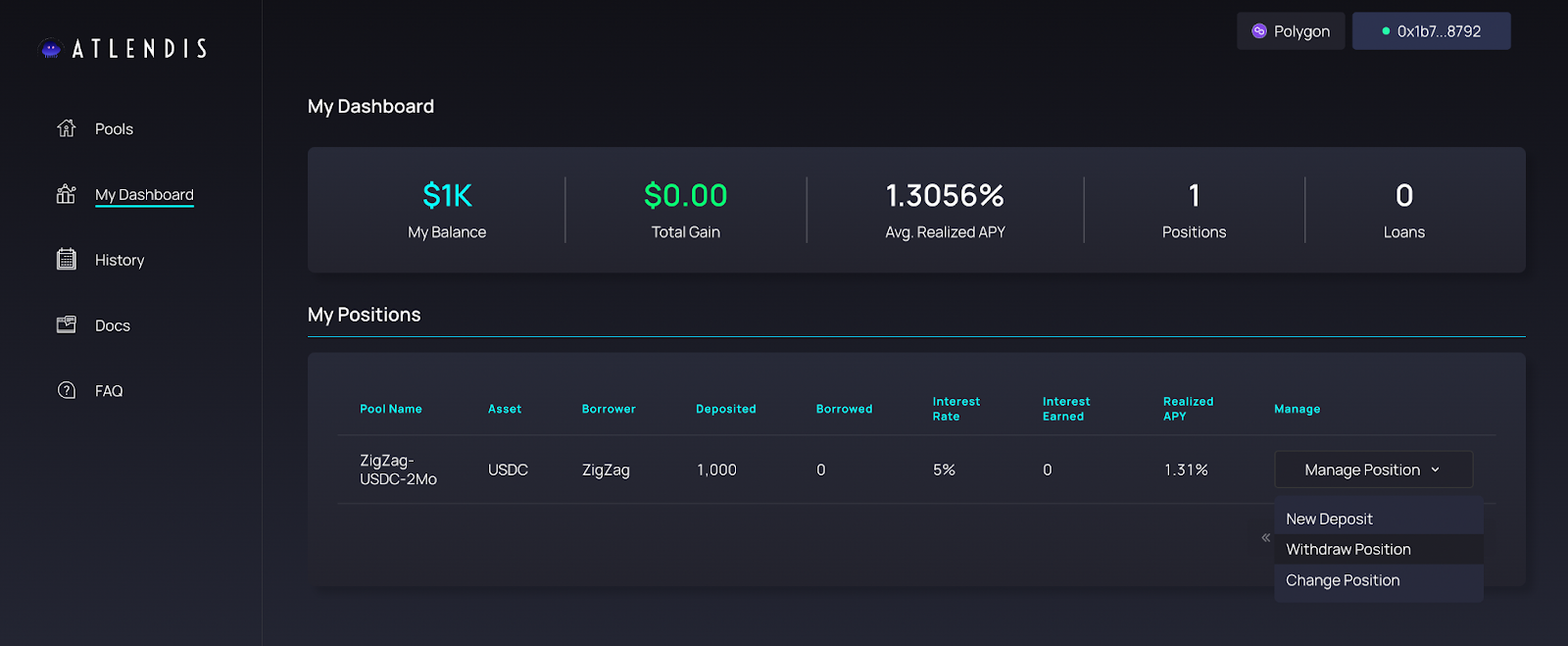

Click “manage” and then select “withdraw position.” You will be directed to the pool page, and you will see that you can have multiple positions in the same pool.

The position you choose in the dashboard is directly preselected in the withdrawal form. However, you can still decide to choose another position to withdraw.

You can check the summary of your position and then click “Confirm Withdrawal.” Your wallet will prompt a confirmation, and once the transaction is completed, your funds will be deposited into your wallet and a confirmation will pop up on the dApp, with a link to your transaction on the blockchain explorer.

Change Your Rate

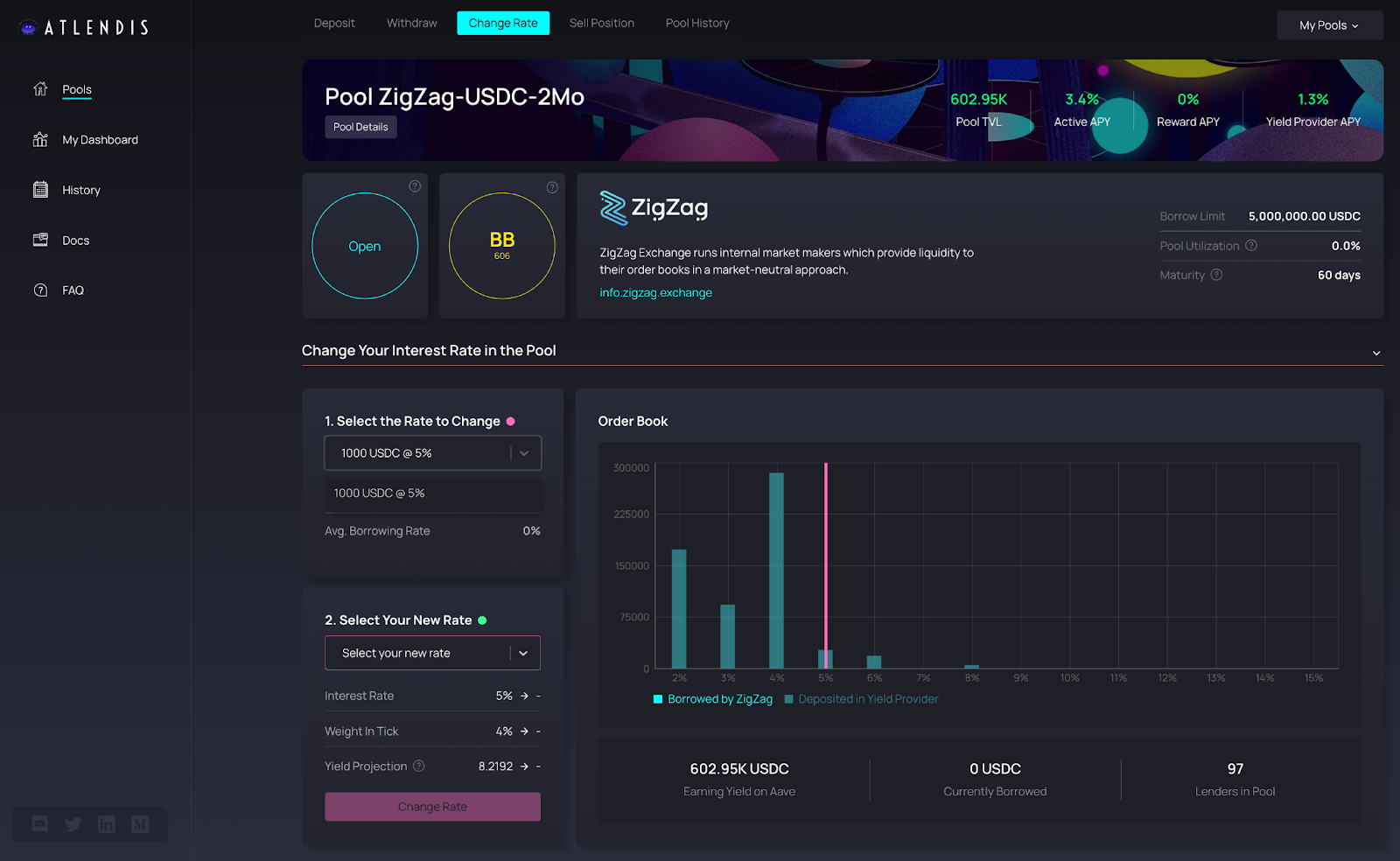

If the rate you originally chose for your position is too high, borrowers might not match your position in a loan very often. Therefore, you may want to lower your lending rate. In these cases, you can choose to change your rate. This is possible only if your funds are not currently being borrowed.

If you would like to change your rate, go to “My dashboard” and select the position that you would like to change. Click “Manage” then select “Change Position."

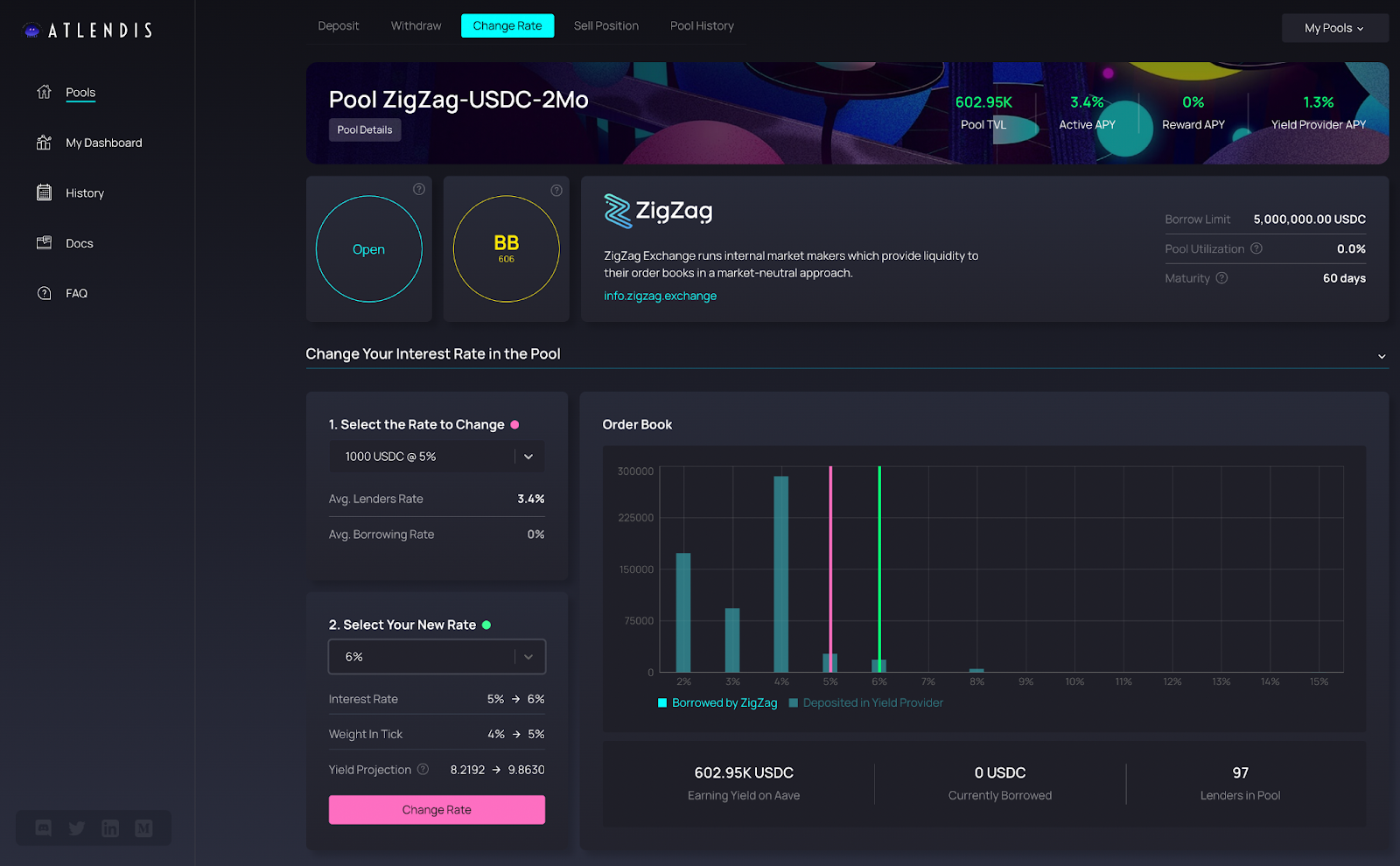

Next, choose the position with the rate you would like to change under “Select the Rate to Change.” A pink line will appear in the order book that shows your current rate.

Select your new rate for this position under “Select Your New Rate,” and a green line will appear showing your new selection in the order book. You can see the variations on your previous rate and your new selection in the metrics below.

Then click “Change Rate” to change your rate. Your wallet will prompt a confirmation, and once the transaction is completed, a confirmation will pop up on the dApp with a link to your transaction on the blockchain explorer.

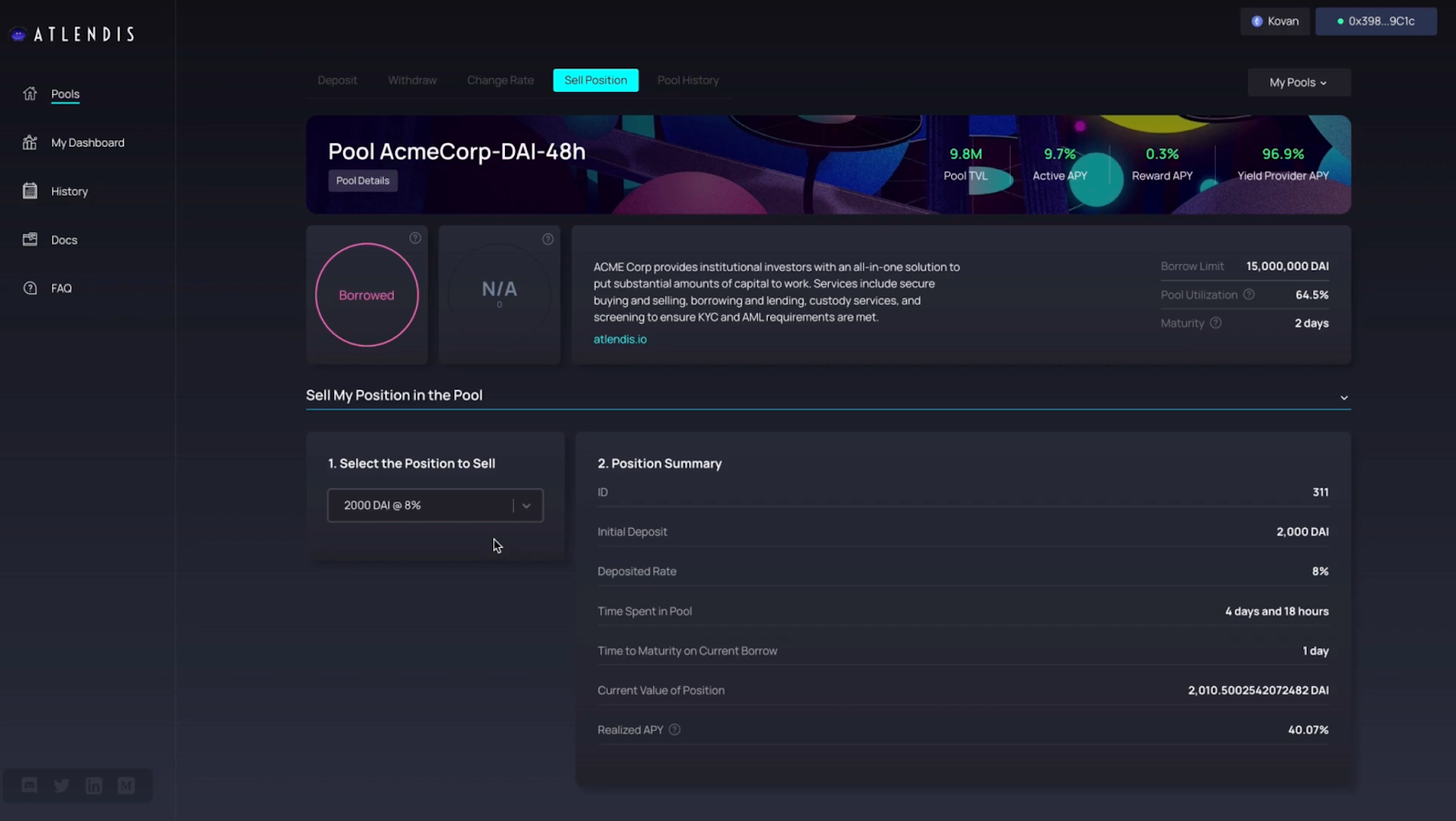

Sell Your Position

If your funds are currently locked, but you would like to exit the pool, you have the possibility to sell your position while the funds are being borrowed. Your position consists of an NFT that can be sold on the secondary market.

It is not possible to sell your position via the Atlendis dApp, however, you can sell your position on your own using an NFT marketplace that will accept it, such as opensea.io or rarible.com.

To get started, go to “My dashboard” and select “Manage” then click “Sell Position.”

In the “Sell Position” section, you can select your position in order to see a summary of your position that is currently being borrowed. This information can be helpful for you to decide whether to sell your position or not, and what price you should choose for it. Please note that all positions on the Atlendis protocol are part of the same NFT collection, so two positions can be from different pools and/or include different assets.

Note that if your funds are not currently being borrowed, your position will not appear in the “Sell Position” tab, and you should withdraw your assets using the “Withdraw” tab.

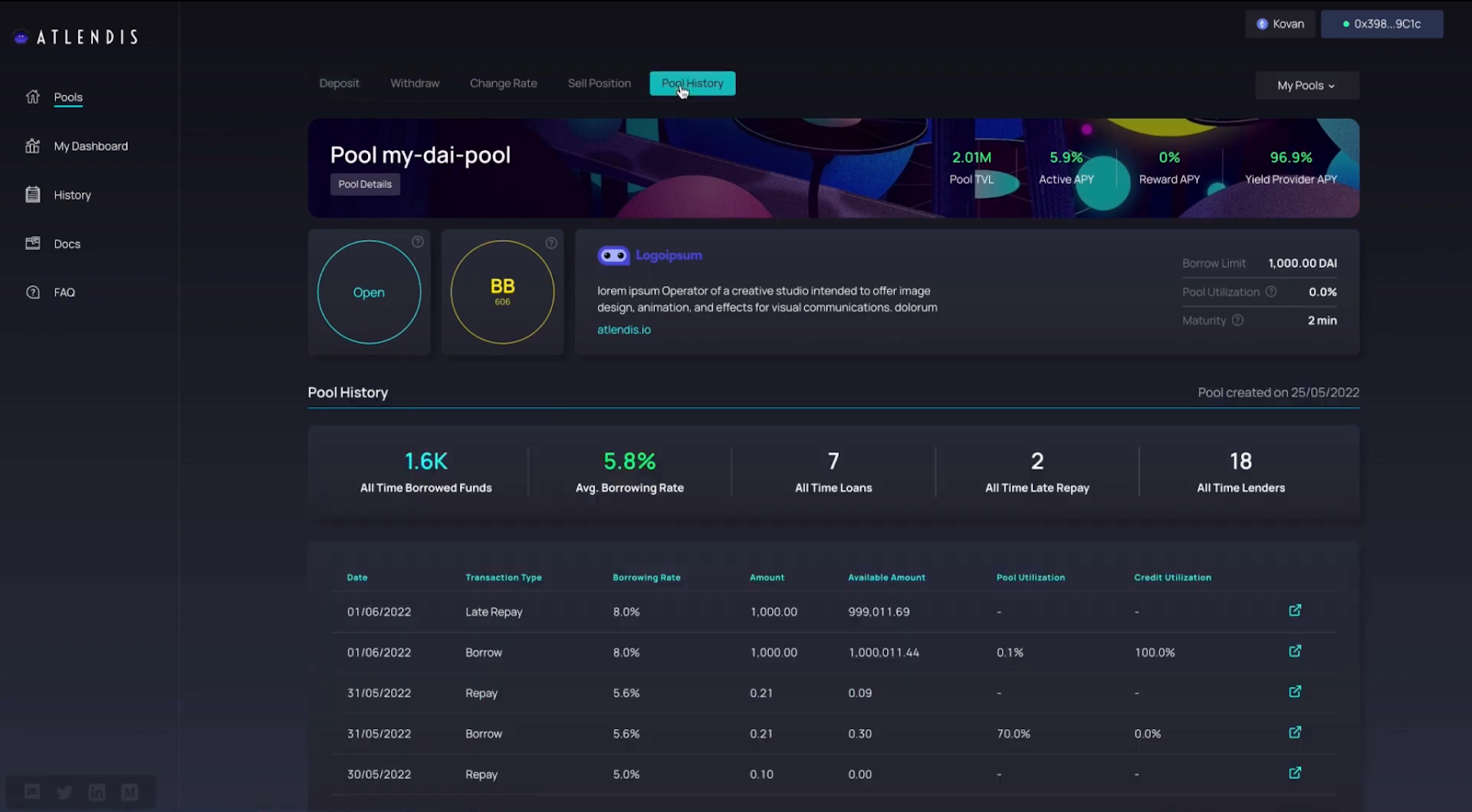

Pool History, Status and Credit Evaluation

On each pool page, you are able to use the “Pool History” tab to access the history of the borrowing actions and the evolution of the pool TVL, the “Governance History” and the “Allowed Borrowing Address.”

The “Pool History” shows all of the actions taken by the borrower. For example, you can see how much they have borrowed, repaid, etc.

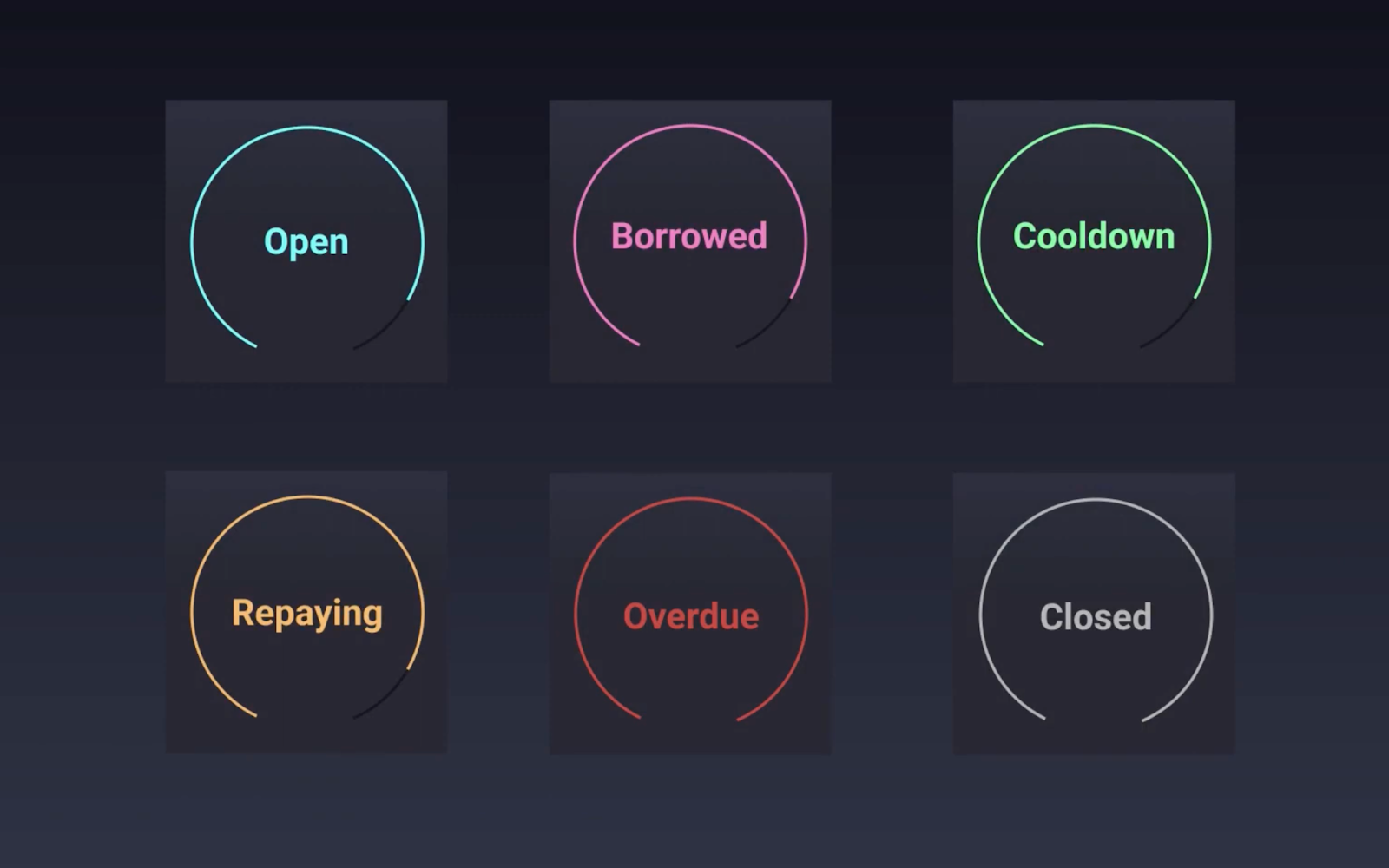

Let’s dive deeper within the dApp and see how the status of the pools is working. Each status has a dedicated color that allows you to understand the state of the pool.

- Blue is open, which means that you can deposit funds, and borrowers can take out a loan at any time.

- Pink is being borrowed, which means that matched positions are locked until repayment, and new deposits will be in pending state, and included into the pool after repayment.

- Green is cool down, meaning that the borrower cannot take out another loan while the pool is in this state.

- Orange is repayment.

- Red is overdue, which means that the borrower missed the repayment window, and is paying late repay fees to the liquidity providers.

- Gray is closed which means that the pool has been retired, deposits and borrows are deactivated, and you can withdraw funds.

It is very important to check the status of the pool before making a deposit.

Another important detail regarding borrowers’ early repayment option. If you see a mention “Early Repay Activated” under the name of the pool, pay special attention, as this means that the borrower is allowed to repay their loan in advance, which can impact the return.

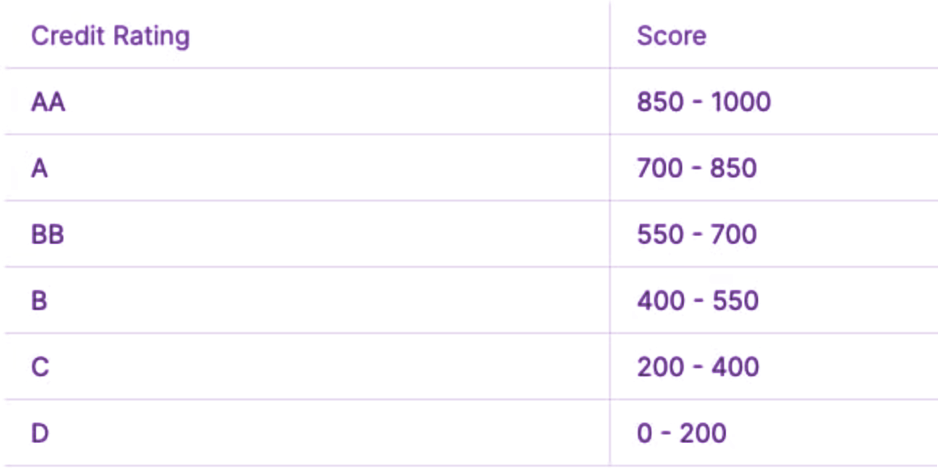

Regarding borrowers creditworthiness, the Atlendis whitelisting process consists in a thorough due diligence of borrowers by Credora. The credit evaluation that results from Credora’s evaluation will be displayed on the Atlendis protocol, continuously updated with live data. Credora’s credit evaluation will reduce the inherent risk of DeFi lending by providing greater visibility to lenders using the Atlendis protocol.

This table provided by Credora shows the equivalence between credit rating and score. More information on Credora’s credit evaluation can be found here.

Additional Resources

app.atlendis.io | Atlendis.io | Whitepaper | LinkedIn | Twitter | Discord | Newsletter | Medium | Audit reports 1 and 2